A guide to reporting a change correctly

Introduction

Clients in receipt of legal aid must report any change in their financial circumstances. This is to ensure that they are paying an appropriate income contribution in the Crown Court or continue to be eligible in the magistrates’ court.

For Crown Court trials, they will not become ineligible once we have granted legal aid, but they may be liable for a high contribution. If we have refused legal aid or they can no longer afford their income contributions, they may also wish us to reassess.

You must submit a new application detailing their new circumstances. See below for how to complete the form. If we have rejected an application, and there’s since been a change, you should not amend the existing form. You will need to provide the information or evidence already requested. Once we have processed this application you can then submit a fresh application detailing their current complete financial circumstances.

NOTE: Applicants should submit a new application as soon as possible after the change. If income is reduced and we receive the application and evidence within 28 days, we can backdate the reassessment to the date of the change. Otherwise, we will date the change from when you submitted the new application – unless you provide a reasonable explanation for the delay.

We cannot consider a change in financial circumstances after a case has concluded.

Completing the application

We cannot accept paper forms, whether by post, email, or uploaded to the previous application. You must submit a new application.

Magistrates court trials, and Crown Court trials where an applicant is paying a contribution

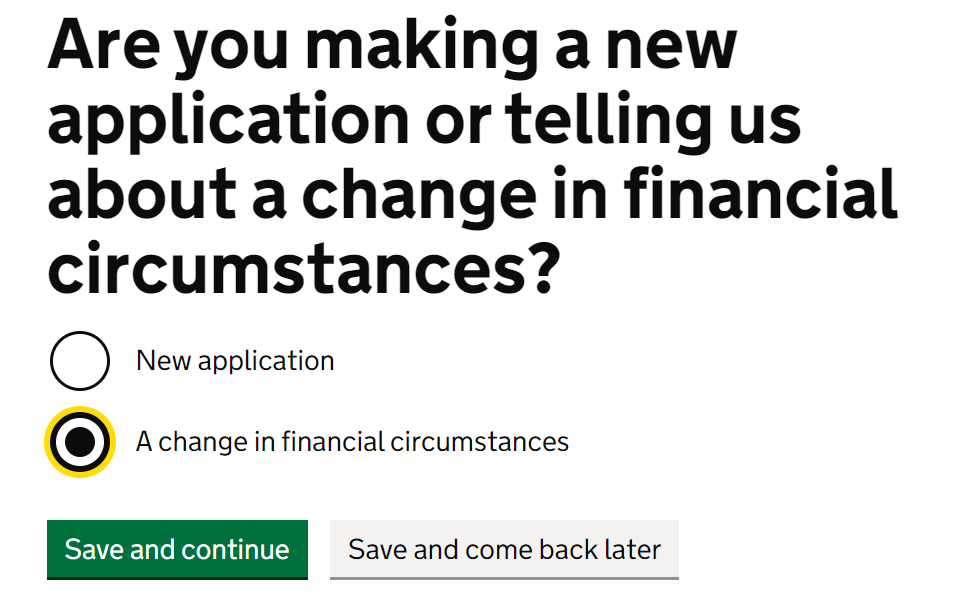

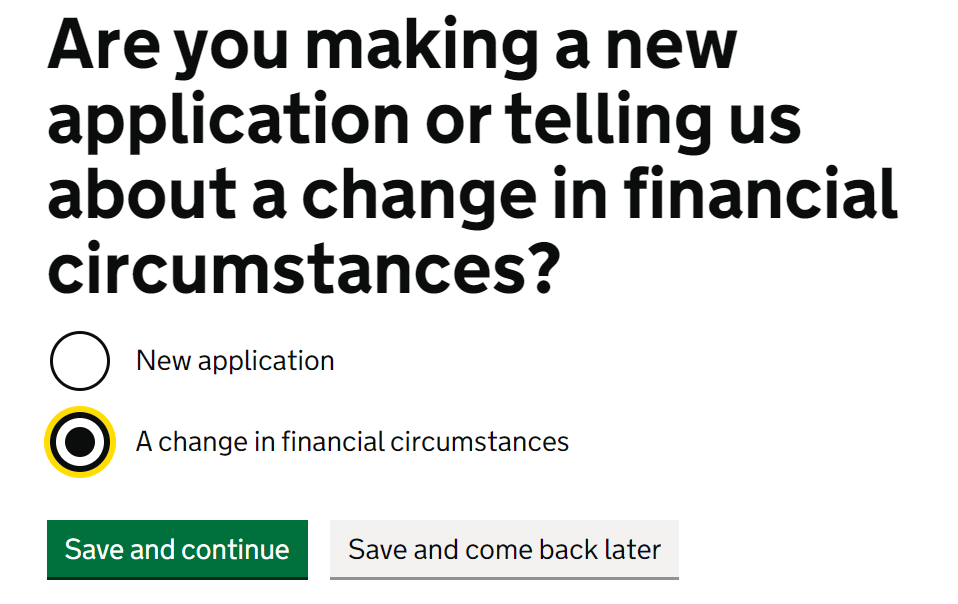

Select ‘A change in financial circumstances’ and provide the original MAAT reference or USN.

Crown court trials where we have assessed them as ineligible

Select ‘A change in financial circumstances’ and provide the original MAAT reference of USN. You should also tell us in the message field that it is a ‘new application following ineligibility’.

NOTE: As well as declaring new information and providing evidence, it helps us if you can explain the nature of the change as this is not always clear.

Evidencing the change

Evidence to confirm the change is mandatory in all cases, whether the matter is in the magistrates’ or the Crown Court. If there is more than one change, we need to see evidence of each one. A few common examples are:

- Loss of employment – Provide a P45 or dismissal letter and an explanation of why the client has left their employment. This enables us to confirm that the applicant has actually lost their employment and is in not avoiding an income contribution in the Crown Court or a refusal. Provide proof of any claim for benefits. We may also need an explanation of how the client is now supporting themselves.

- Moved home – Provide a new tenancy or mortgage agreement and tell us their new annual council tax liability as this may also have changed.

- Obtained employment – Provide a wage slip or a letter from their new employer. If their entitlement to housing benefit or council tax benefit has changed then provide evidence of the rent and council tax they now need to pay.

- Loss of self-employment – They should provide closing accounts or a letter from their accountant. If they cannot provide these, then they can provide bank statements showing no income being received or proof of a claim for benefits.

- Now in receipt of a passported benefit – You should conduct the DWP check and so that we can backdate, evidence the date the benefits were awarded.

- Restraint order now made – Provide a copy of the restraint order.

See Section 14 of the Criminal Legal Aid Manual (CLAM)for full guidance on changes in financial circumstances.