Providers checking client financial eligibility for legal aid can now access a spreadsheet tool used by our caseworkers.

This tool should only be used as a guidance support tool alongside the resources available on our GOV.UK means testing page. The spreadsheet does not replace the need for a full assessment of a client’s finances.

The accuracy of the results in the spreadsheet depends on the accuracy of the information entered.

You may find the eligibility key card useful in assessing financial eligibility. Feedback on the spreadsheet is welcome.

NOTE: This calculator is intended to be used as a guide only and does not replace the need for a full assessment of an applicant’s finances. The accuracy of the result provided depends entirely on the accuracy of the information entered and it should be used in conjunction with the Lord Chancellors Guidance and key card.

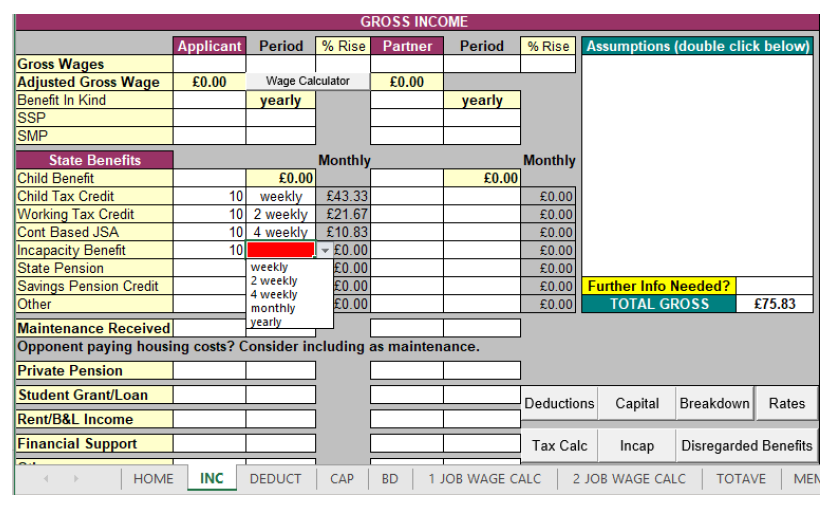

State Benefits

Frequency of payments

There is an option within the State Benefit section to enter figures as:

- weekly

- 2 weekly

- 4 weekly

- monthly

- yearly

The image below shows this drop-down selection in the calculator.

Financial support from the National Asylum Support Service (NASS)

As financial support from NASS is not a wage it should be entered under State Benefits – Other. This will ensure that no employment expense figure is applied.

Property calculations

The calculator is set to automatically deduct 3% selling costs from the property value (in line with the eligibility calculations for Certificated Work). Providers who do Controlled Work and/or Family Mediation need to be aware of this when doing their calculations as a 3% deduction should not be made when assessing eligibility at those levels of service.