How and when to claim interim payments on account (POAs) on CCMS

During the lifetime of a case, both solicitors and counsel are entitled to claim interim payments for costs for either third-party fees, such as experts, or their current running costs to date.

POAs are an interim ‘loan’ in effect which will be offset against the final bill. These are not considered a final payment and must be accounted for within your final claim for costs.

- POAs can be either a disbursement (for solicitors) or a profit costs POA (for solicitor or counsel) at certain trigger points during a case.

- Disbursement POAs can be claimed at any time by the solicitor for 100% of any expert or third-party invoice that requires payment.

- Profit Cost POAs are allowed only 3 months after the emergency certificate is issued and then only 4 can be claimed in the following 12-month rolling period. Each claim can be up to 80% of your running costs to date.

- Previous Profit Cost claims will be taken into account on any subsequent claims which will mean only 80% of the overall running total will be paid.

NOTE: All POAs paid will be recouped when the final bill is paid. If POAs are not accounted for in your final bill, then this will leave a shortfall for the costs claimed as a POA.

Counsel’s fees

You have 2 options for how and when counsel claim their costs:

- Assign and allocate counsel to CCMS for them to claim directly:

- counsel give you a fee note or estimated costs

- you assign counsel to the case and allocate each a cost limit based on the estimates

- counsel can then claim an interim POA

- when the case concludes, each counsel will receive a CCMS notification to submit their final claim

- we assess solicitor and counsel final bills together

- Bill on behalf of counsel within your bill:

- you must agree this with counsel

- you must upload a signed fee note from counsel confirming they agree for you to bill on their behalf

- we will pay counsel fees to you as part of your bill for you to then pay each counsel

- you do not need to assign or allocate costs to counsel

- counsel cannot claim an interim POA

You may also choose a hybrid approach if multiple counsel are instructed. You can assign and allocate some but bill on behalf of others.

Reporting the case outcome

When the case concludes you need to report the outcome of proceedings.

Use the Outcome task on CCMS to report these details and request the discharge of the funding certificate if it remains ‘Live’.

Date of final work on the case and the relevant Outcomes Codes must be entered in a completed Outcome task which can be found in the ‘Record Outcome’ section of the case on CCMS.

Where there is a favourable financial outcome for the client you will need to report this as a separate award within the Outcome tasks. This will be if the client has a costs order in their favour or receives any damages which would fall under the Statutory Charge.

As part of the Outcome task, you will need to report any legal help costs incurred in the pre-certificate section.

Finally, you should upload a copy of the final order as evidence or if no final order was made then respond to the document request confirming the same to ensure your Outcome is processed promptly.

NOTE: You cannot submit a final bill without first reporting the outcome of the case.

Submit a final bill to claim payment (solicitor and counsel)

Once an Outcome task has been submitted and you have been notified it has been processed you will have the option to create and submit a Final Bill.

Refer to Table 10(a) rates from Schedule 1 – Remuneration Regulations 2013.

| Activity | Higher courts | County and magistrates’ |

| Routine letters out | £6.75 per item | £5.94 per item |

| Routine telephone calls | £3.74 per call | £3.29 per call |

| Preparation and attendance | £71.55 (London) £67.50 (Non-London) | £63 (London) £59.40 (Non-London) |

| Attendance at court or conference with counsel | £33.30 | £29.25 |

| Advocacy | £67.50 | £59.40 |

| Travelling and waiting | £29.93 | £26.28 |

Counsel should refer to Table 1 rates from Schedule 2 – Remuneration Regulations 2013.

| Activity | Higher courts | County and magistrates’ |

| Preparation and attendance | £71.55 (London) £67.50 (Non-London) | £63 (London) £59.40 (Non-London) |

| Attendance at court or conference with counsel | £33.30 | £29.25 |

| Advocacy | £67.50 | £59.40 |

| Travelling and waiting | £29.93 | £26.28 |

You can also access the Civil Finance Electronic Handbook.

Step 1

Ensure you have the option for ‘Solicitor Final’. If you do not, please check the Outcome task has been submitted for every proceeding on the certificate.

Step 2

Follow the questions through, answering if the client has a financial interest (such as paying contributions, revoked certificate, and financial recovery and if the bill has been court assessed.

You will then reach the below question. You should indicate ‘yes’ where you are billing on behalf of any Counsel in the second question and yes to the first question if you have any disbursements to claim.

Step 3

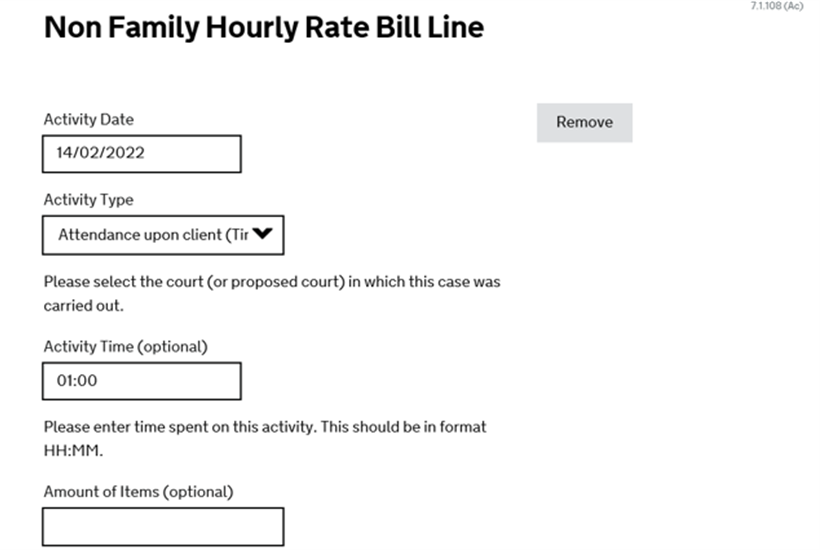

Enter the court type where proceedings concluded and if there are multiple courts involved. You will reach the below screen for Non-Family Billing for Solicitor work only.

You should enter each line of work undertaken from your file such as 1 hour of attendance on the client, clicking ‘Add’ after each one.

NOTE: CCMS will generate the correct rate from the rules base, therefore you only need to confirm either the hourly rate, enhancement and VAT or the number of items (such as letters, enhancement, and VAT.

When all work has been completed for the Solicitor you can click ‘Next’ which will then move on to billing on behalf of Counsel.

Step 4

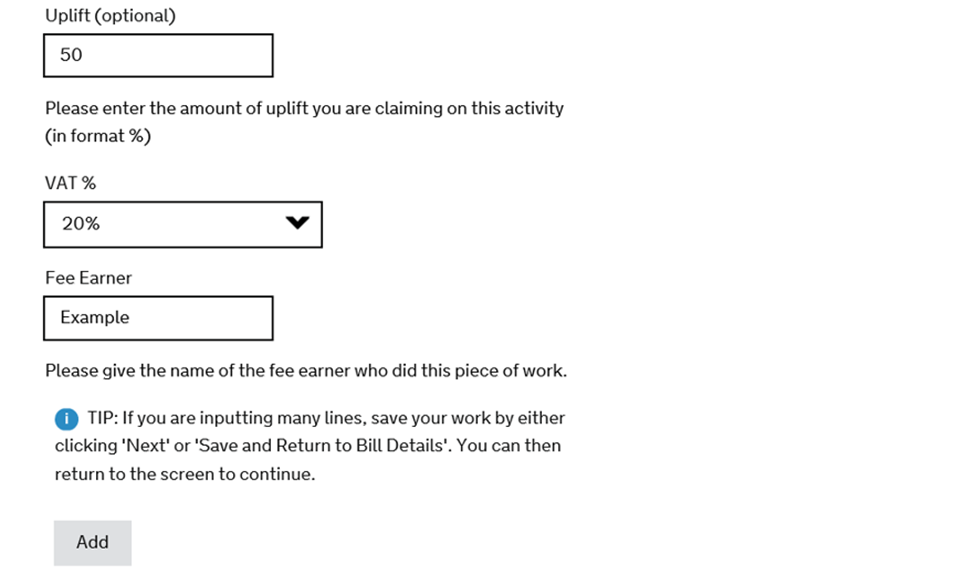

Billing on behalf of Counsel will initially ask if you Counsel will be claiming enhancement (only if they are Junior Counsel in the County Court) on their costs. You should reply accordingly and move on to the next screen.

Step 5

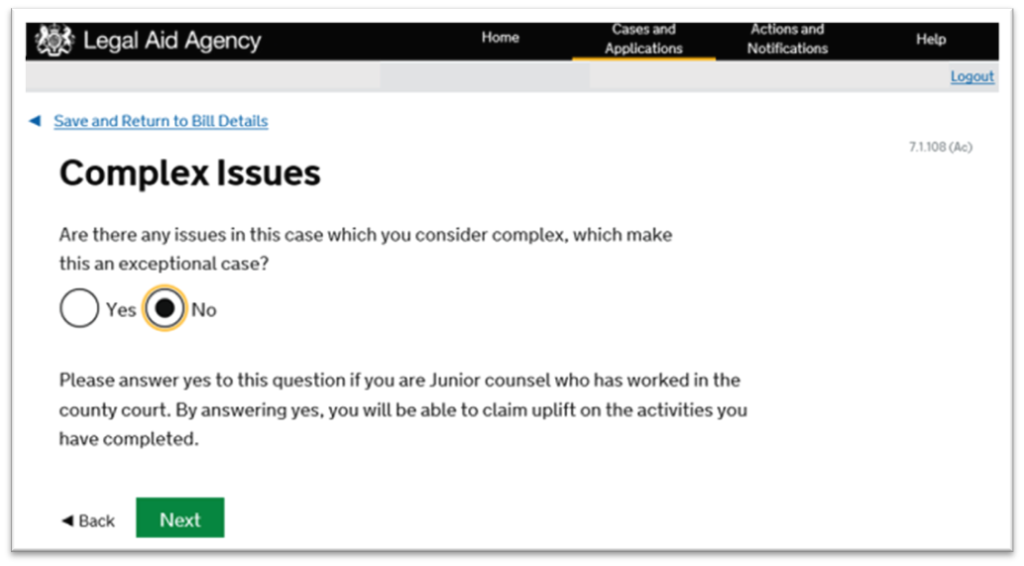

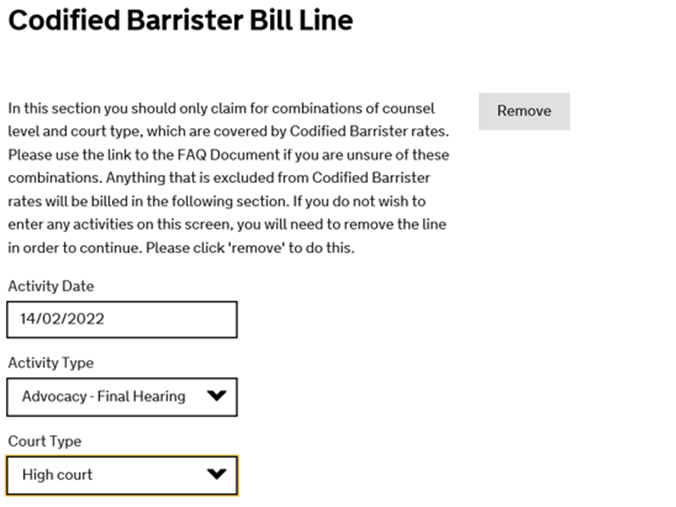

Codified Barrister Rates Screen. If you are not claiming within the Codified Rates Scheme for Counsel, click ‘Remove’ on the bottom of this page and go to the ‘Exclusions from Codified Rates’ Screen. This will be where there is no combination of Counsel and Court which falls under the Codified Rates.

If Counsel is claiming Codified Rates, complete as you did with the Solicitor Hourly rates screen and clicking add to enter each item of work.

Once complete click ‘Next’ and the Exclusions from Codified Rates screen will appear. Remove this screen if you have already completed the Codified Rates Screen previously.

Step 6

Travel and Waiting for Counsel will be claimed on the next screen and again if using the ‘Exclusions from Codified Rates’ please remove and use the following screen.

Once completed you will have a chance to cross reference what CCMS has generated against what you had expected from your file. If required, you can request a copy of the breakdown by clicking on ‘Request Draft Print’ from the initial submission screen after clicking complete on the bill.

Evidence required on Final Bills

CCMS will generate an automatic document request once your final bill is created and you have clicked ‘Submit’.

It will appear as a notification and will request documents related to the work claimed in terms of disbursements evidence, attendance notes and Counsel evidence.

Please do not send your full file of papers unless it is specifically requested by a caseworker who will direct you.

We only require certain evidence from the file which will be made clear in the notification.

Useful guidance links

Civil Finance Electronic Handbook – all current guidance for all things civil billing:

Civil Finance Electronic Handbook (publishing.service.gov.uk)

Costs Assessment Guidance (CAG) covers points to help with assessment and submission of bills:

Costs_Assessment_Guidance_2018_-_Version_4-_February_2021.pdf (publishing.service.gov.uk)

Queries

Should you have any billing related queries, please lodge a Billing Enquiry on the case in CCMS.