This guide shows you how to input wage slip information for your client within the means assessment. If you indicate that your client is employed you will be asked to provide evidence of the client’s employment income.

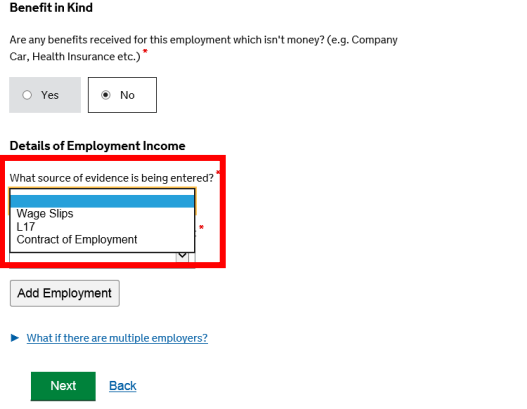

Within the means assessment you can select which form of evidence will be supplied. Wage slips are being chosen for this example.

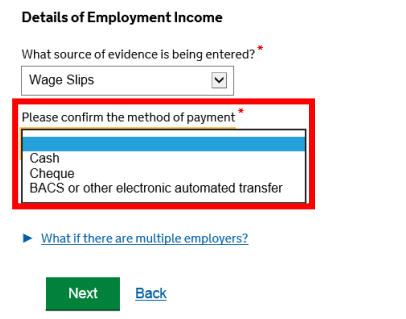

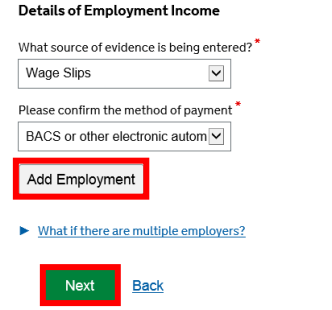

Confirm how the client receives their wage payments.

If the client has multiple employers click Add Employment to add the

additional details. If there is no more information to input click Next.

As you have indicated that wage slips will be provided, CCMS will then ask you to input information about those wage slips.

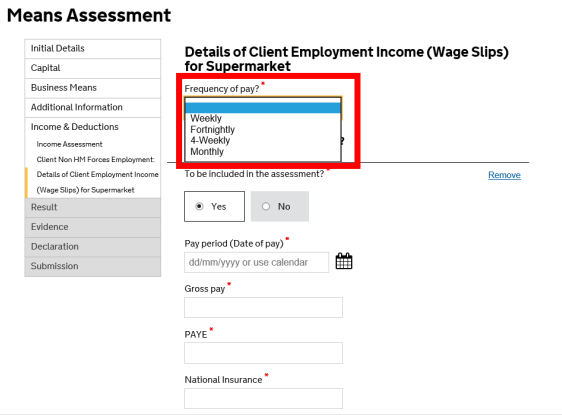

Firstly, you need to specify the frequency of the client’s wage payments. Depending on the answer, CCMS will indicate how many wage slips will need to be provided as evidence.

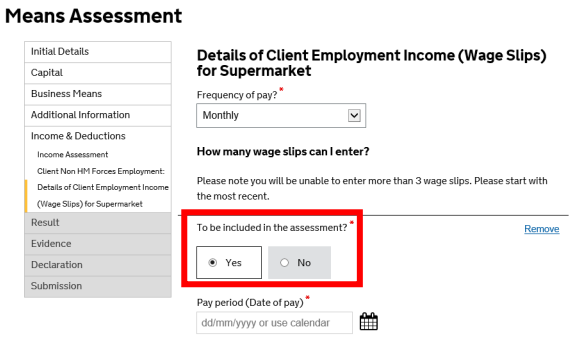

You also need to specify whether the wage slip should be included in the means assessment.

Answering ‘Yes’ will include the income information, answering ‘No’ will discount the wage slip from being included.

You may need to answer No if the client has received any bonus payments etc. on recent wage slips which would not be included in the means assessment.

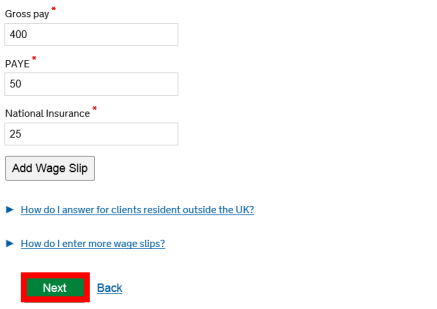

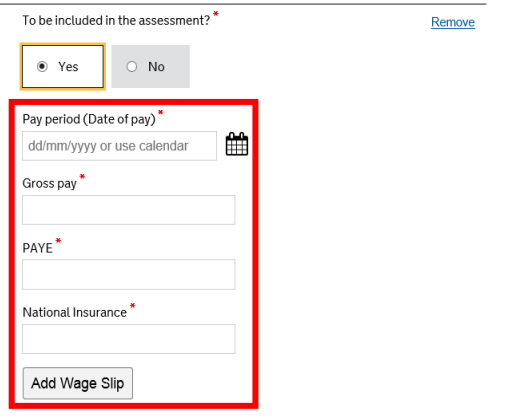

Input the information from the client’s wage slips. The information the LAA require relates to the pay period, gross pay, PAYE and National Insurance. You must add all wage slips that CCMS has indicated you should provide.

Click Add Wage Slip to provide the additional information.

Once all wage slip information has been provided click Next to continue with the means assessment.

You will be asked to upload the wage slips as evidence upon completion of the application.