This guide details the process of submitting a court assessed bill. You should refer to the bill of costs (and EX80) when completing the submission.

Assessment of costs will take place under the normal paper process whereby a bill of costs is drafted and submitted to court for taxation. Once approved you should bill these costs using CCMS.

NOTE: Please remember to record the outcomes for all proceedings so that the final bill option is available.

Please check the scope of the certificate to ensure work claimed is within the dates and limits before submission to the court.

If claiming Advocacy this should be broken down under FAS into the relevant entries. Only summary level figures are allowed on profit costs and disbursements.

Counsel Fees do not need to be detailed on a court assessed bill unless you are claiming on behalf of Counsel (in Non-Family cases only).

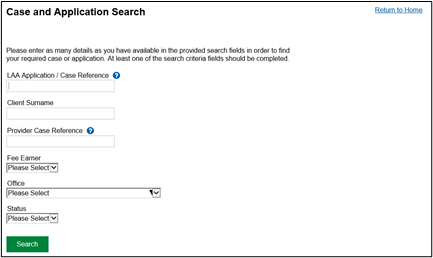

Initiate the billing process by searching for the case you wish to bill against through the Cases and Application section.

Click Search then select the case from the search results.

From the list of Available Actions click Billing.

NOTE: If Outcomes have already been submitted the proceedings showing will be at a status of ‘Outcome’ (rather than ‘Live’). Please ensure this is the status for all proceedings so that a final bill option is available.

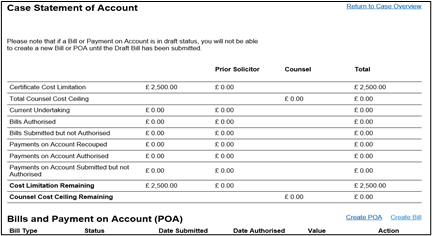

Click Create Bill from the Case Statement of Account screen.

This creates a draft bill which can be saved and returned to at a later date if required.

You will answer some general billing questions, please see the Submit an LAA Assessed Bill guide for further information.

You will be asked if the bill has been assessed or will be assessed by the court.

Answer Yes to follow the court assessed bill route.

Answer No for all other LAA assessed claims.

Click Next.

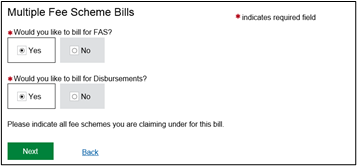

On the ‘Multiple Fee Scheme Bills’ screen you have two options for work that can be billed.

You must select Yes to bill for disbursements as this will activate the ability to bill at a summary level for costs claimed. The court assessments options will appear in the disbursements screen. This will also allow you to bill the disbursements claimed on an item by item basis should you wish to do so.

CCMS will allow you to bill for advocacy broken down into individual items. Please use this option for all cases under the Family Advocacy Scheme. To activate these screens select Yes.

NOTE: You will be asked some general questions around the court type, if there’s been any change in solicitor firm and the client. Answer these questions as appropriate for the case.

You will be directed to the fixed fee screen.

This bill line should be removed to access the relevant summary level screens. Click Remove.

Once the bill line is removed click Next.

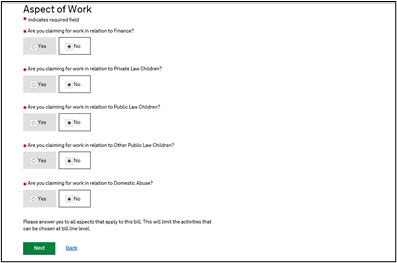

If you are claiming fees under FAS please select the aspect to which the FAS work relates to.

You may select multiple aspects if the matters covers more than one proceeding.

Once selected click Next.

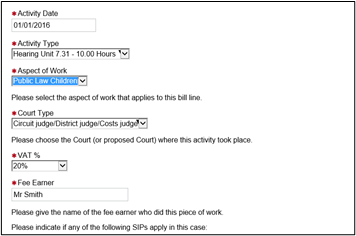

On the FAS Hearing Unit Entry screen complete all mandatory fields.

You can also claim any SIPs authorised on the AAF on this screen.

Click Add for additional hearings or Next when you have input all relevant bill lines.

The FAS Non Hearing Unit Entry screen can be used to claim court bundles and the exceptional travel fee.

These items should correspond with a hearing date entered on the previous screen.

Please complete all mandatory fields.

The Add button can be used to add additional bill lines.

Click Next once all relevant bill lines have been added.

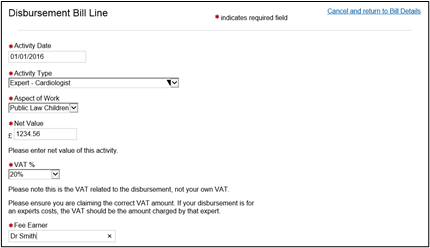

The Disbursement Bill Line screen can be used to enter a breakdown of each Disbursement incurred line by line.

The option exists under this section to enter the hourly rates incurred by an expert if applicable however this field is not mandatory.

Click Add to enter each Disbursement line.

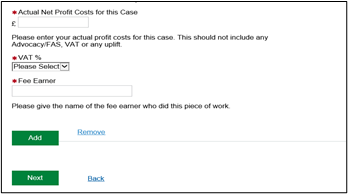

When entering Summary Level costs (Profit Costs, Disbursements, Costs of Assessment Only) you must select one of the last 5 options from the Activity Type dropdown in the Disbursements screen.

Enter each summary entry as a separate line, using the Add button to add additional bill lines.

Costs of Assessment only relates to those costs deemed as such. Please see the civil finance electronic handbook for full details.

Other costs detailed in Box C on EX80 are not deemed to be Costs of Assessment and should be claimed as Profit Costs.

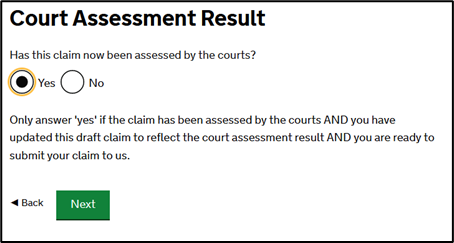

You will be asked if the claim has been assessed by the court.

If completing a draft version of the bill answer No. CCMS will not allow you to submit the claim until the court assessment is complete.

If you have received the court assessment result answer Yes.

Click Next.

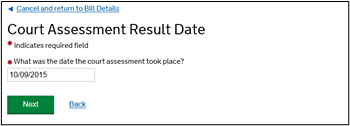

If you have answered Yes to the previous question you will need to input the date of court assessment, which can be found on the assessment result certificate.

Click Next.

To see a full breakdown of the bill created click Request Draft Print and you will receive a notification with the details.

Clicking Bill Summary will allow you to download a copy of the bill at this point.

Once you are ready to submit the bill to the LAA click Submit or click Cancel and return to Financials Summary should you wish to leave the bill in draft.

The Submission Confirmation screen confirms the bill has successfully been submitted.

Click Next to continue working in CCMS.

NOTE: Once the bill has successfully been submitted, a Documents Required Action will be sent to the user who submitted the bill. You should attach the supporting documentation to this Action to allow the LAA to process the bill.

For Court Assessed bills the LAA requires the following documentation:

- Assessment certificate

- Bill of costs

- Disbursement list, numbered and cross-referenced against the vouchers, court orders, ledgers. This schedule is to be used if the summary level for disbursements utilised

- Applicable court orders

- Any explanatory notes (e.g. a solicitors’ covering letter)

Please see the Submitting Electronic Evidence guide.