Billing guidance for providers holding a 2022 Standard Crime Contract (Back to top)

Introduction

Part 3, Sections 28 – 29 of the Domestic Abuse Act 2021 allows the police to apply to the Magistrates Court for a Domestic Abuse Protection Order (DAPO) to protect a victim from domestic abuse. The application to the Magistrates Court will generally be made after the police have previously issued a Domestic Abuse Protection Notice (DAPN) to the alleged perpetrator of the abuse. These cases are in scope for civil funding pursuant to Schedule 1, Part 1, paragraph 11 of the Legal Aid, Sentencing and Punishment of Offenders Act 2012. This includes applications to vary an injunction and appeals to the Crown Court. Please note, the civil legal services prescribed under Part 1 are subject to the exclusions in Parts 2 and 3 of Schedule 1.

However, Section 28 of the Domestic Abuse Act 2021 also allows for the person for whose protection the order is sought to apply for a Domestic Abuse Protection Order. These applications must be made to the Family Court.

In this guidance these injunctions are referred to as DAPO’s. This guidance has been developed specifically to support providers who are less familiar with the civil legal aid billing process. The document applies specifically to providers holding a 2022 Standard Crime Contract when instructed for a DAPO in the Magistrates’ Court or Family Court.

Funding for DAPO’s is provided as part of civil legal aid.

There are significant differences from criminal legal aid to keep in mind in the billing process and will require claims to be submitted on our Client and Cost Management System (CCMS).

Payments on Account (POAs) (Back to top)

How and when to claim POAs on CCMS

During the lifetime of a case, solicitors are entitled to claim Payments on Account (POA) for costs for either third-party fees, such as experts, or their current running costs to date.

POA are payments made on account of amounts due in respect of contract work before we have paid the final Claim. These are not considered a final payment and will be accounted for within your final claim for costs by being offset against the final payment. This is an action that the LAA will take when paying the final claim.

POAs can be either a disbursement or a profit costs POA at certain trigger points during a case. Counsel may also claim POA.

Disbursement POAs can be claimed at any time by the solicitor for 100% of any expert or third-party invoice that requires payment.

Profit Cost POAs are allowed only 3 months after the emergency certificate is issued. Only 4 POA can be claimed in a 12-month rolling period. Generally, up to 80% of your running costs to date can be paid via a POA.

Please note the overall running total of Profit Costs should be included in your claim for a Profit Cost POA. The system will then calculate 80% of the costs that have not previously been claimed as a POA.

DAPO’s in the Family Court will generally fall under the Private Family Law Representation Scheme (PFLRS) and Family Advocacy Scheme (FAS). These are fixed fee schemes for profit costs and advocacy costs. Where fixed fees apply, your POA will be limited to 80% of your costs to date up to 80% of the applicable fixed fees.

NOTE: All POAs paid will be recouped when the final bill is paid. If POAs are not accounted for in your final bill, this will leave a shortfall for the costs claimed as a POA.

There are CCMS step-by-step guides for each type of POA:

Payments on account of profit costs

Claiming disbursements on account

Counsel POAs

Where proceedings are heard in the Magistrates’ Court POA are also available to counsel on three monthly intervals starting 3 months after the issue of the funding certificate. Generally, up to 80% of counsel’s running costs to date can be paid via a POA.

Please note, generally, counsel fees in the Family Court will fall under the Family Advocacy Scheme (FAS). If counsel fees fall under the FAS, counsel are not entitled to POA.

Counsel (Back to top)

Allocating counsel fees

Where you have instructed counsel, they are generally allocated their own costs limitation on CCMS.

You’ll need to assign and allocate counsel to CCMS for them to claim directly.

Counsel claiming under the Family Advocacy Scheme (FAS) in the Family Court

- Counsel provides you with a fee note or estimated costs.

- You review the amount requested by counsel to ensure they are claiming the correct fixed fee (generally, the hearing where a determination in respect of the DAPO is set will be a final hearing).

- You assign counsel to the case and will need to allocate each counsel a cost limit based on the agreed estimates (counsel’s allocation should be for their net costs).

- Counsel can then claim their fee under the FAS directly from LAA.

- Before submitting the solicitor final bill, you must check CCMS to ensure all counsel fees have been settled under the FAS and that the costs claimed match their allocation.

- You must not include counsel fees in your claim for Family Court DAPO’s.

Counsel claiming in the Magistrates’ Court

- Counsel provides you with a fee note or estimated costs.

- You assign counsel to the case and allocate each counsel a cost limit based on the agreed estimates.

- Counsel can then claim any POA as applicable.

- When the case concludes and the solicitor final bill is received, each counsel allocated costs will receive a CCMS notification to submit their final claim.

- We will assess solicitor and counsel final bills together.

Billing on behalf of counsel

Alternatively, in the Magistrates’ Court you may agree with counsel to bill on their behalf:

- You must agree this with counsel.

- You must upload written confirmation from counsel confirming they agree for you to bill on their behalf.

- We will pay counsel fees to you as part of your bill for you to then pay each counsel.

- You should not assign or allocate costs to counsel.

- Counsel cannot claim an interim POA.

You may also choose a hybrid approach if multiple counsel is instructed. You can assign and allocate some but bill on behalf of others.

For further guidance on counsel fees please see:

Provider Billing With Counsel

Allocate Cost to Counsel

Outcomes (Back to top)

Reporting the case outcome

When the case concludes you need to report the outcome of proceedings.

Use the Outcome task on CCMS to report these details and request the discharge of the funding certificate if it remains ‘Live’.

Date of final work on the case and the relevant Outcomes Codes must be entered in a completed Outcome task which can be found in the ‘Record Outcome’ section of the case on CCMS.

Where there is a favourable financial outcome for the client you will need to report this as a separate award within the Outcome tasks. This will be if the client has a costs order in their favour or receives any damages which would fall under the Statutory Charge.

Guidance on how to report an Outcome task and discharge a certificate with or without a Costs or Damages Award is available here:

Recording Outcomes and Discharge

Reporting Outcomes/Discharge with a Cost or Damages Award

Final Bills in the Magistrates’ Court (Back to top)

Solicitor hourly rates

Once an Outcome task has been submitted you will have the option to create and submit a Final Bill. DAPO’s in the Magistrates’ Court will attract hourly rates. CCMS will generate the applicable rates so you will not enter these directly into CCMS.

Refer to Table 10(a) rates from Schedule 1 – Remuneration Regulations 2013.

| Activity | Higher courts | County and Magistrates’ |

| Routine letters out | £6.75 per item | £5.94 per item |

| Routine telephone calls | £3.74 per call | £3.29 per call |

| Preparation and attendance | £71.55 per hour (London) £67.50 per hour (Non-London) | £63.00 per hour (London) £59.40 per hour (Non-London) |

| Attendance at court or conference with counsel | £33.30 per hour | £29.25 per hour |

| Advocacy | £67.50 per hour | £59.40 per hour |

| Travelling and waiting | £29.93 per hour | £26.28 per hour |

Counsel hourly rates

Counsel should refer to Table 1 rates from Schedule 2 – Remuneration Regulations 2013.

| Activity | Higher courts | County and Magistrates’ |

| Preparation and attendance | £71.55 per hour (London) £67.50 per hour (Non-London) | £63.00 per hour (London) £59.40 per hour (Non-London) |

| Attendance at court or conference with counsel | £33.30 per hour | £29.25 per hour |

| Advocacy | £67.50 per hour | £59.40 per hour |

| Travelling and waiting | £29.93 per hour | £26.28 per hour |

Creating a final bill – step-by-step (Back to top)

To create a final bill on CCMS refer to:

Non-family bills

Non-family billing webinar

Cost Assessment Guidance

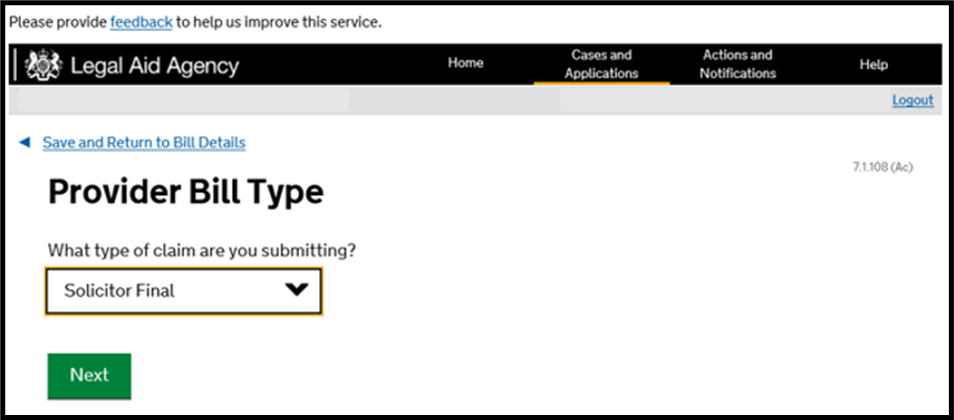

Step 1

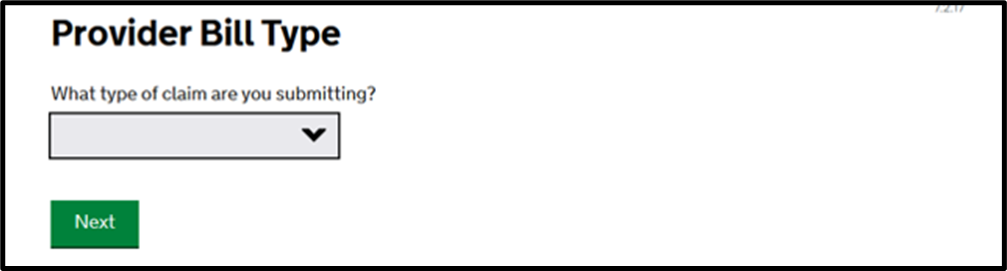

Ensure you have the option for ‘Solicitor Final’. If you do not, please check the Outcome task has been submitted for every proceeding on the certificate.

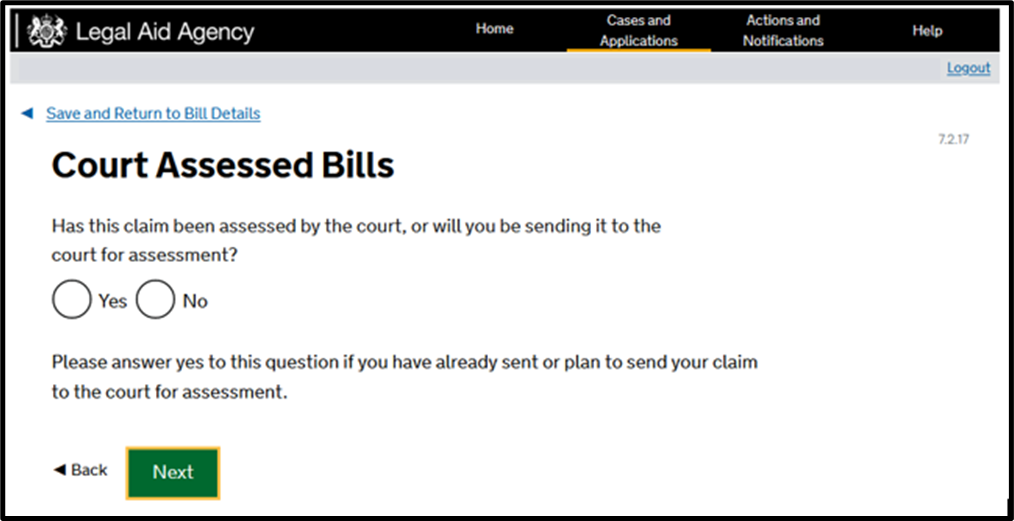

Step 2

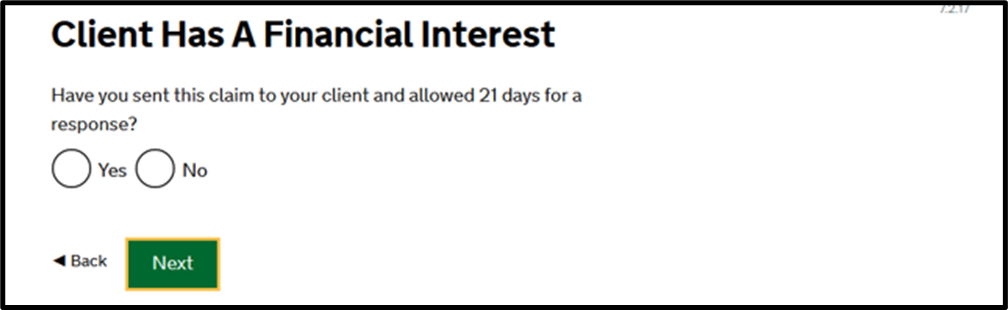

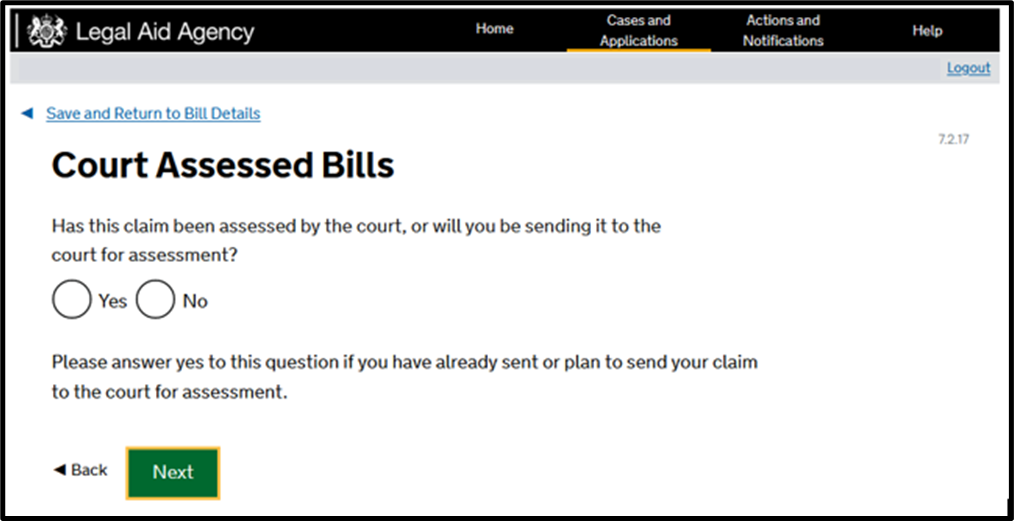

Follow the questions through, answering if the client has a financial interest (such as paying contributions, revoked certificate, and financial recovery) and if the bill has been court assessed (generally, proceedings in the Magistrates’ Court will not qualify for court assessment). Further guidance on court assessment, including where costs payable to the Client by another party to the proceedings have been ordered is available in Section 15 Costs Assessment Guidance

Step 3

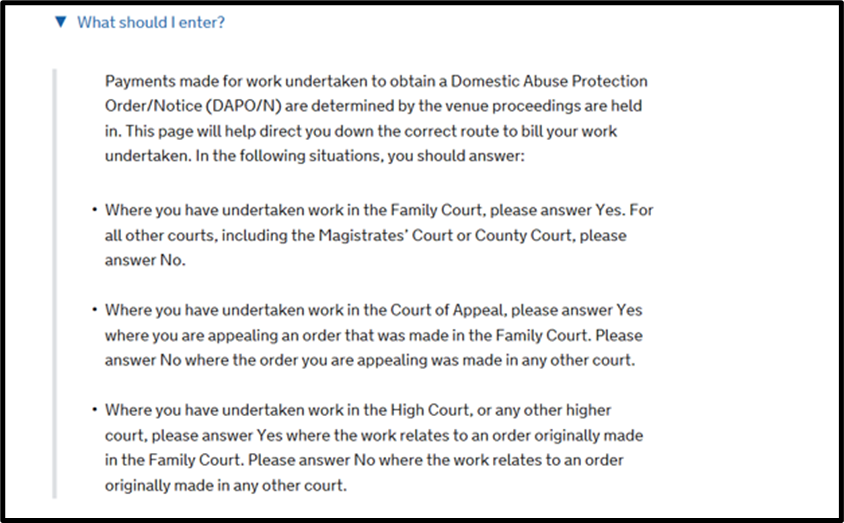

The payment scheme for DAPOs is determined by the court venue and not the contract held by a provider. CCMS will therefore ask you to confirm whether proceedings were issued in the Family Court or not? You should answer ‘No’ for proceedings issued in the County Court or Magistrates Court.

Additional help text on CCMS confirms the following:

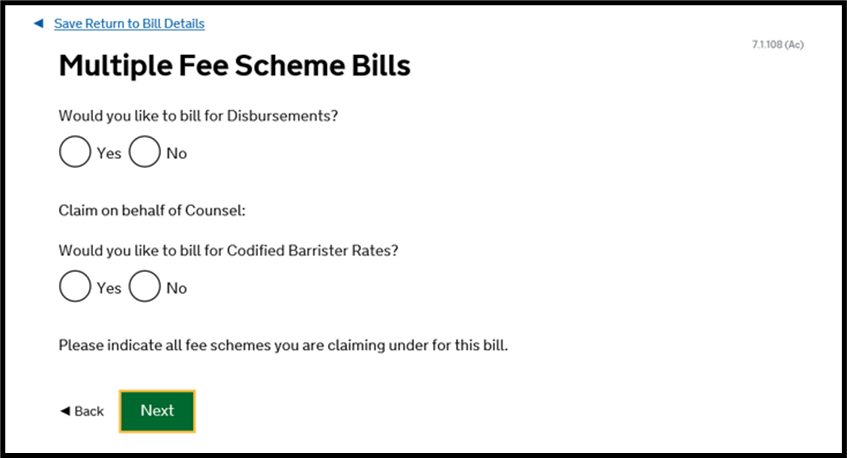

Step 4

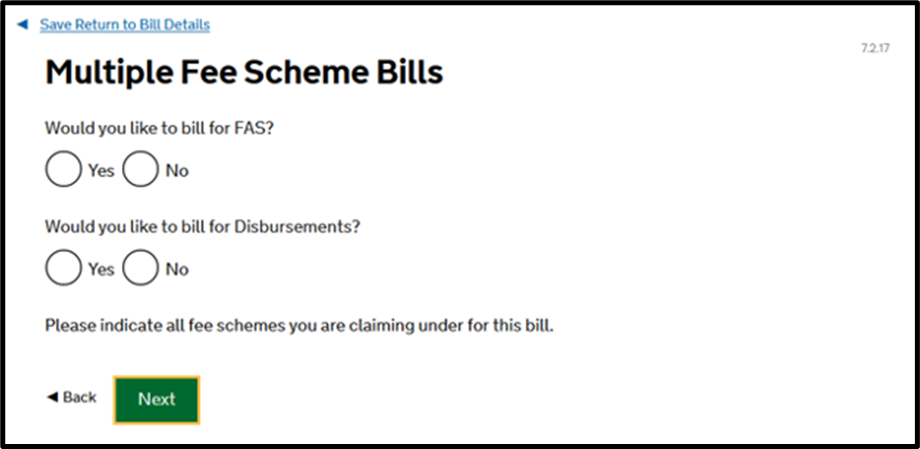

You will then reach the below question. You should indicate ‘Yes’ where you are billing on behalf of any counsel in the 2nd question and ‘Yes’ to the first question if you have any disbursements to claim.

Step 5

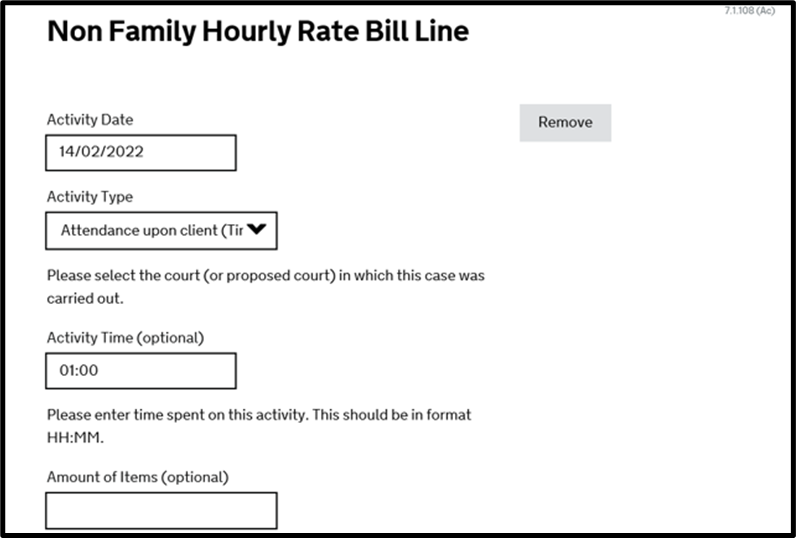

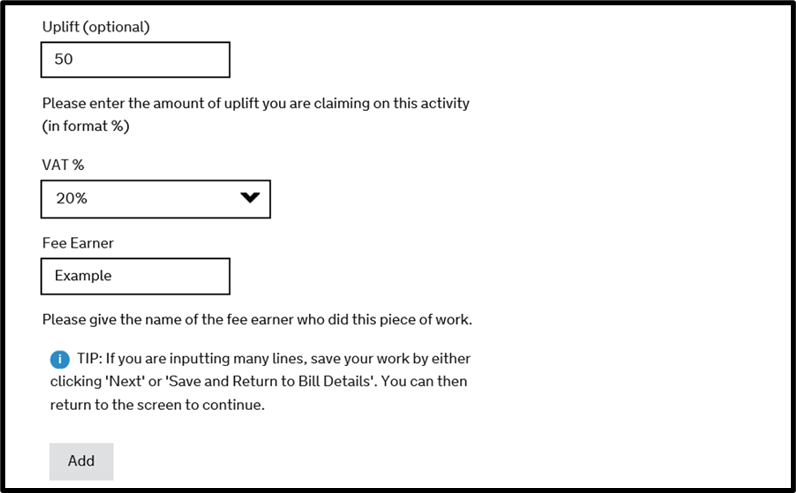

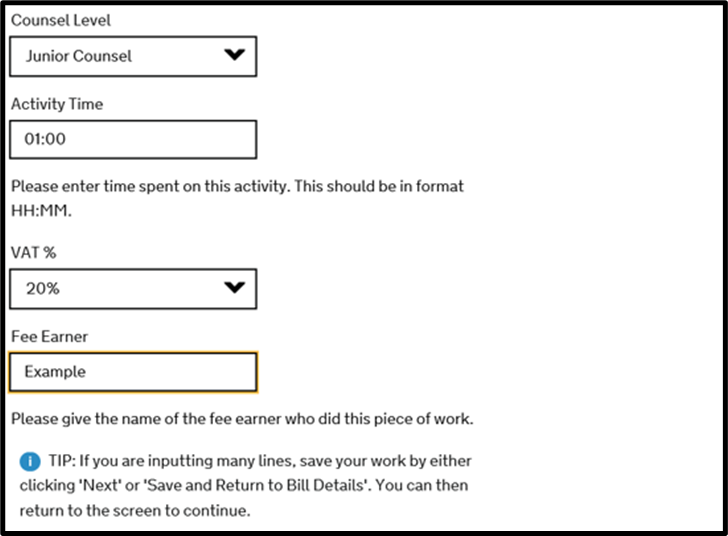

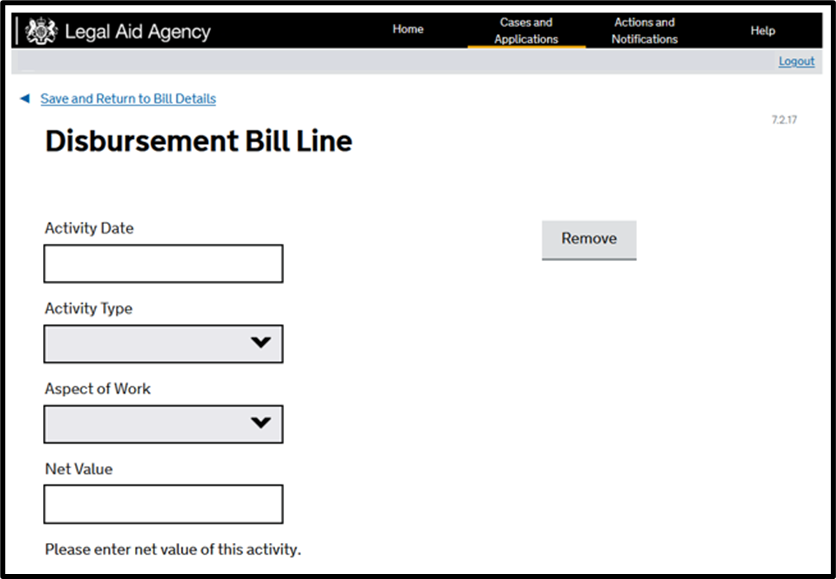

Enter the court type where proceedings concluded and if there are multiple courts involved. You will reach the below screen for Non-Family Billing for solicitor work only.

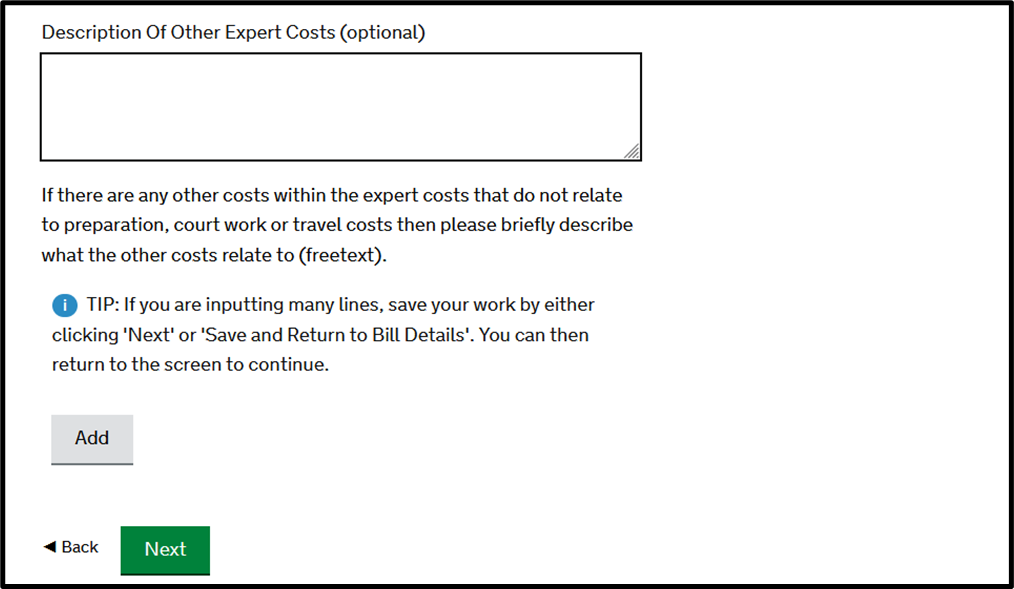

You should enter each line of work undertaken from your file such as 1 hour of attendance on the client, clicking ‘Add’ after each one. CCMS will generate the correct rate from the rules base, therefore you only need to confirm either the activity type and activity time for non-routine work or the activity type and amount of items for routine work, such as routine letters and telephone calls.

When all work has been completed for the Solicitor, you can click ‘Next’ which will then move on to billing on behalf of counsel.

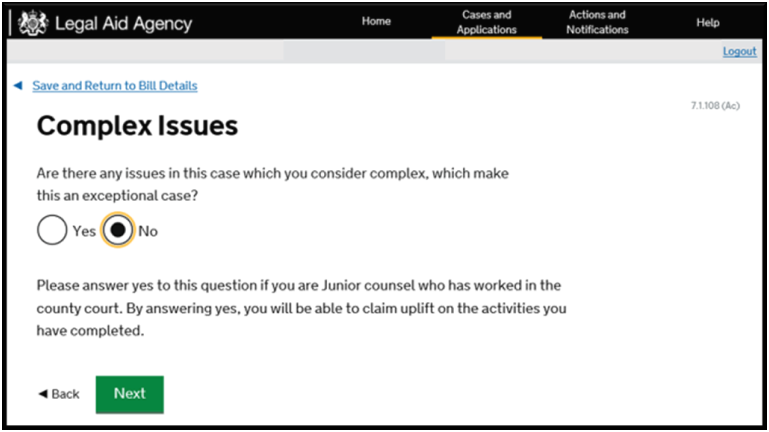

Step 6

Billing on behalf of counsel will initially ask you if counsel will be claiming enhancement (only if they are junior counsel in the County Court) on their costs. You should reply accordingly and move on to the next screen.

Step 7

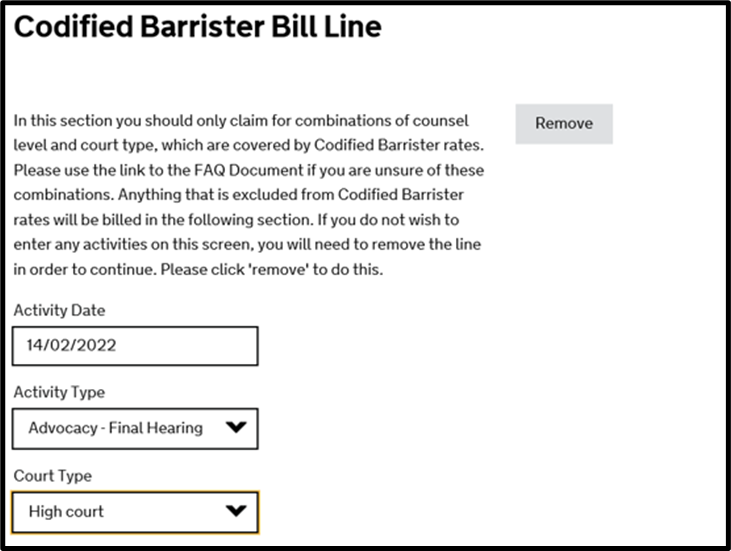

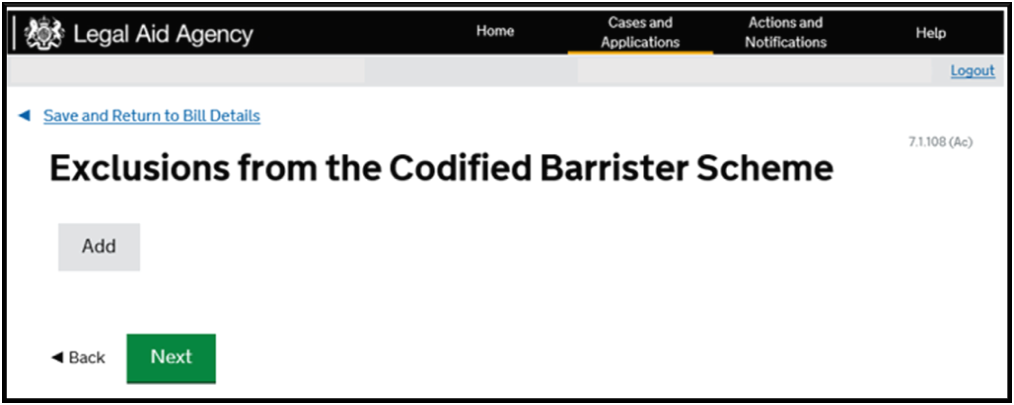

Codified Barrister Rates Screen. If you are not claiming within the Codified Rates Scheme for counsel, click ‘Remove’ on the bottom of this page and go to the ‘Exclusions from Codified Rates’ Screen. This will be where there is no combination of counsel and court which falls under the Codified Rates.

If counsel is claiming Codified Rates, complete as you did with the Solicitor Hourly rates screen and clicking add to enter each item of work.

Once complete click ‘Next’ and the Exclusions from Codified Rates screen will appear. Remove this screen if you have already completed the Codified Rates Screen previously.

Step 8

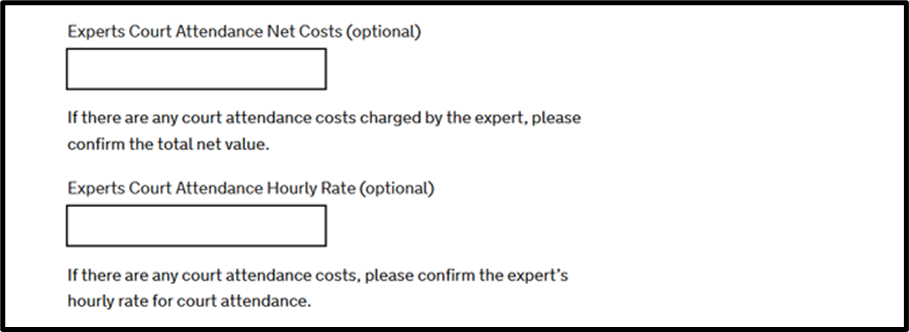

Travel and Waiting for Counsel can be claimed on the next screen. Once completed you will have a chance to cross reference what CCMS has generated on the Assessment Summary screen against what you had expected from your file. If required, you can request a copy of the breakdown by clicking on ‘Request Draft Print’ from the initial submission screen after clicking complete on the bill.

Supporting documents (Back to top)

CCMS will generate an automatic document request once your final bill has been created and you have clicked ‘Submit’.

It will appear as a notification and will request documents related to the work claimed in terms of disbursements evidence, attendance notes and counsel evidence.

Please do not send your full file of papers unless it is specifically requested by a caseworker who will direct you.

We only require certain evidence from the file which will be made clear in the notification.

Please see Section 10 of the Civil Finance Electronic Handbook for Guidance on disbursements and the guide on how to reply to the standard billing document request.

Actions, notifications and documents – Billing Document Request

Civil Finance Electronic Handbook

Final Bills in the Family Court (Back to top)

Family fixed fee schemes

DAPO’s in the Family Court will generally fall under the Private Family Law Representation Scheme (PFLRS) and Family Advocacy Scheme (FAS).

Guidance on billing under these schemes can be found in Appendices 1 and 2 of the Costs Assessment Guidance and sections 5 and 6 of the Electronic Handbook.

Costs Assessment Guidance

Civil Finance Electronic Handbook

Further guidance on creating bills under these fixed fee schemes can be found here:

Submit FAS / FGF Claim

Civil family billing: getting your family fixed fee bills right first time

Private Family Law Representation Scheme (PFLRS)

The PFLRS is a fixed fee scheme. Refer to Table 3(h) from Schedule 1 – Remuneration Regulations 2013.

| Region | Person or court before whom proceedings are heard | Legal Representation Standard Fee |

| London | Justices’ legal adviser, lay justice, judge of district judge level, judge of circuit judge level or costs judge | £608 |

| London | Judge of High Court judge level or Court of Protection | £729 |

| Non-London | Justices’ legal adviser, lay justice, judge of district judge level, judge of circuit judge level or costs judge | £507 |

| Non-London | Judge of High Court judge level or Court of Protection | £608 |

Where there has been a transfer of provider, each provider will be entitled to half of the Legal Representation Standard Fee, unless their running profit costs are equal or above the fixed fee, in which case they will be entitled to the full fixed fee.

Escaping from the PFLRS

Where your profit costs are three times more than the Legal Representation Standard Fee, profit costs will escape the fixed fee and will be paid on an hourly rate basis.

The following costs are not taken into consideration when calculating whether profit costs escape the fixed fee:

- Any enhancement claimed on top of the Other Family Proceedings prescribed hourly rates;

- Advocacy costs; and

- Bill preparation.

Refer to Table 9(b) rates from Schedule 1 – Remuneration Regulations 2013.

| Activity | Higher courts | Justices’ legal adviser, lay justice, judge of district judge level, judge of circuit judge level or costs judge |

| Routine letters out | £6.35 per item | £5.40 per item |

| Routine letters in | £3.15 per item | £2.70 per item |

| Routine telephone calls | £6.35 per call | £5.40 per call |

| Preparation and attendance | £70.56 per hour (London) £65.75 per hour (Non-London) | £59.40 per hour (London) £54.90 per hour (Non-London) |

| Attendance at court or conference with counsel | £37.13 per hour | £32.40 per hour |

| Advocacy | £70.56 per hour (London) £65.75 per hour (non-London) | £59.40 per hour (London) £56.70 per hour (non-London) |

| Travelling and waiting | £32.18 per hour | £28.80 per hour (London) £27.90 per hour (non-London) |

Family Advocacy Scheme (FAS)

Both solicitors and counsel are paid under the FAS in the Family Court. Unlike the PFLRS, there is no escape mechanism for FAS.

A Standard Fee may be claimed for the provision of advocacy at a hearing. This covers all work relevant to such hearings including incidental work and preparation such as drafting of skeleton arguments, court orders, attendance notes, travel time (save for exceptional travel) and waiting at court as well as the advocacy within the hearing itself.

Generally, a final hearing fee will apply to the hearing where the DAPO is made. Final hearings are paid per day.

However, where there are earlier hearings, an interim hearing fee may apply. Hearing Unit 1 will be paid for interim hearings of 1 hour or less. However, longer interim hearings will attract Hearing Unit 2. Where interim hearings are longer than 2.5 hours, multiple Hearing Unit 2 fees may be claimed:

1 minute – 60 minutes: Hearing Unit 1

61 minutes to 150 minutes: 1x Hearing Unit 2

151 minutes to 300 minutes: 2x Hearing Unit 2

301 minutes to 450 minutes: 3x Hearing Unit 2

And so forth.

Refer to Tables 2(b) and 2(d) from Schedule 3 – Remuneration Regulations 2013.

| Person or court before whom proceedings are heard | Hearing Unit 1 (up to 1 hour) | Hearing Unit 2 (up to 2.5 hours) | Final Hearing fee (per day) |

| Justices’ legal adviser or lay justices | £81.50 | £203.76 | £361.17 |

| Judge of district judge level, judge of circuit judge level or costs judge | £81.50 | £203.76 | £361.17 |

| Judge of High Court judge level | £81.50 | £203.76 | £361.17 |

Family Court cases excluded from the fixed fees

There are some exceptions where DAPO’s in the Family Court will fall outside of the PFLRS and FAS and will be paid on an hourly rates basis, including the following circumstances:

- Proceedings where you represent a client under the age of 18 at the point public funding was granted from.

- Cases where you are instructed for less than 24 hours (this will apply where the client stops instructing you within 24 hours whilst proceedings are ongoing).

- Where the client has previously instructed a different Provider in respect of the same work and the Certificate has not been transferred.

Where proceedings in the Family Court are excluded from the fixed fee schemes, the Other Family Proceedings prescribed hourly rates in Table 9(b) of the Remuneration Regulations 2013 apply.

There are no prescribed rates for counsel in family matters excluded from the FAS. However, LAA will generally consider the Other Family Proceedings prescribed hourly rates to be reasonable.

Creating a final bill – step-by-step (Back to top)

Step 1

Once outcomes have been submitted you will have the option to submit a final bill.

Step 2

Confirm whether your client has a financial interest in the matter, for instance if the certificate has been revoked, the client will have a financial interest.

Step 3

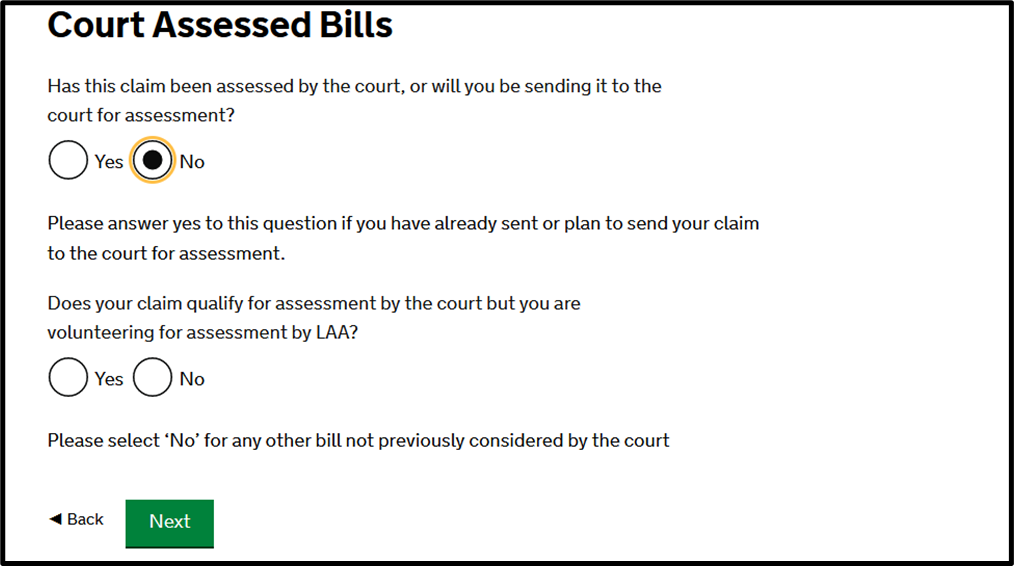

Confirm whether the bill is to be assessed by the Court or LAA.

Generally, all claims will be assessed by the LAA. However, where your claim meets the threshold (i.e. the assessable costs are over £2500 and the matter concludes before a district judge, circuit judge, costs judge or higher) you may opt for the court to assess your claim.

In order for the court to carry out assessment, you would need to create a Bill of Costs for HMCTS and then upload this and a copy of the sealed assessment certificate with your claim on CCMS, once the court has carried out assessment (please note where a detailed assessment of costs payable to the Client by another party to the proceedings is ordered, your claim must be assessed by the court).

Step 4

Confirm whether you wish to claim any FAS or disbursement costs.

Step 5

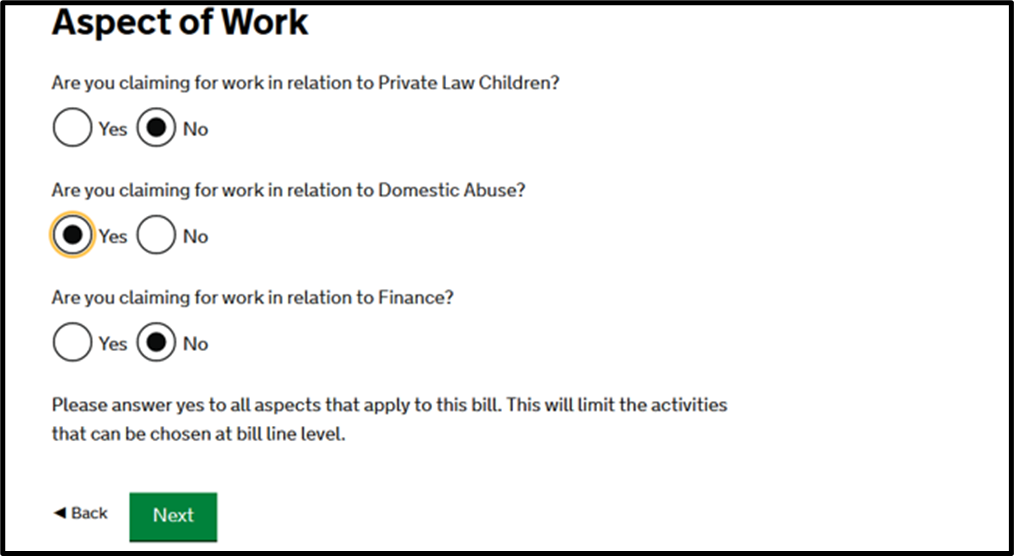

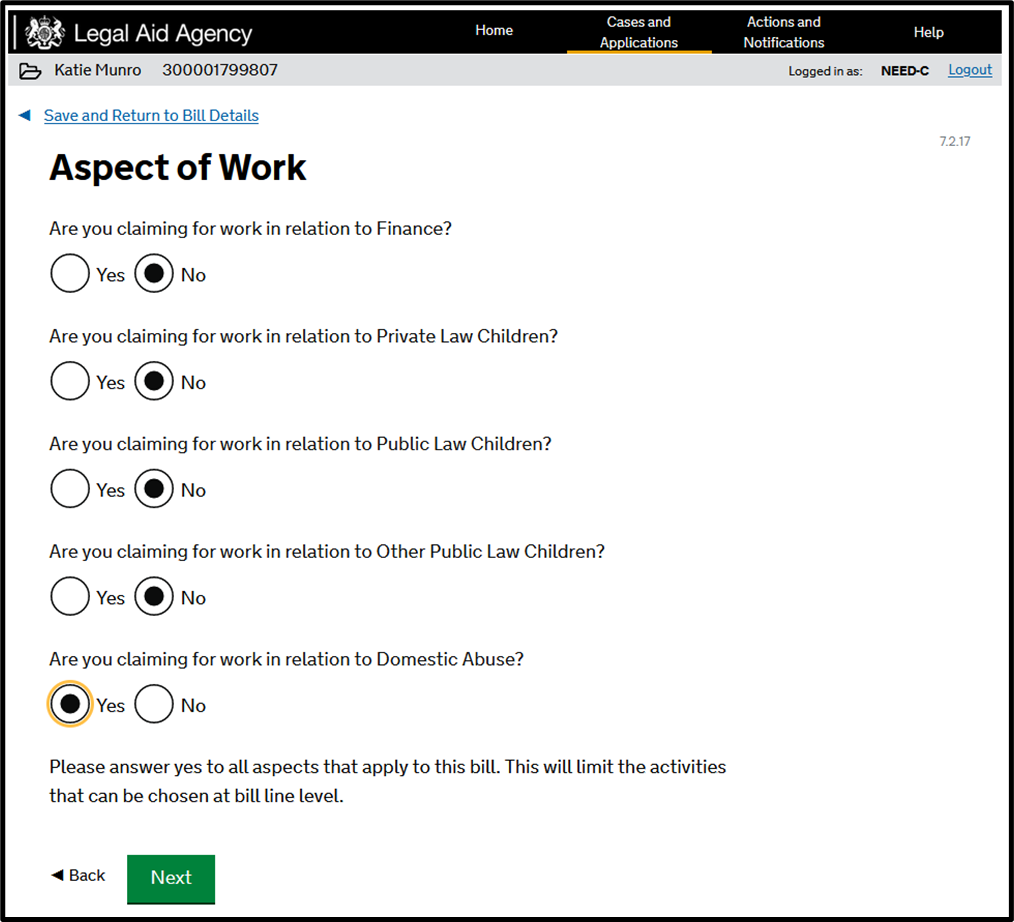

Continue through answering the questions confirming the court type (this will be the level of judge in the family court), whether there has been a transfer of solicitor, the number of clients represented and the Aspect of work.

Where your claim falls under the PFLRS and FAS you should claim for work in relation to the Domestic Abuse Aspect. Please note, if you are representing a child (eg a client under 18 when the certificate was first issued), you will be taken to the Prescribed Family Hourly Rates screen instead.

Step 6

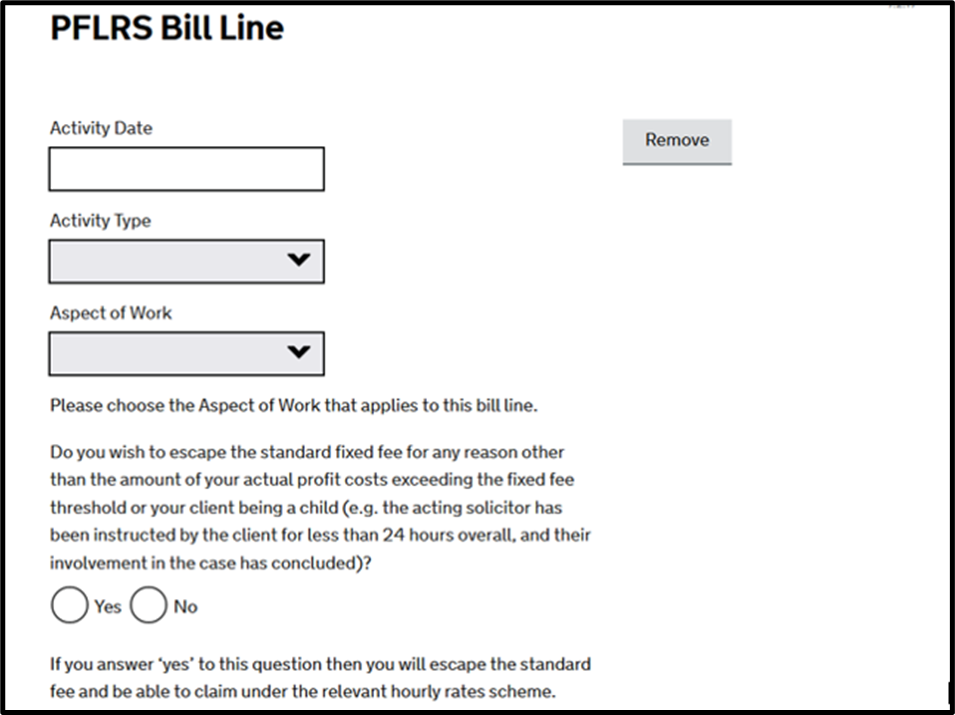

Enter details of your claim.

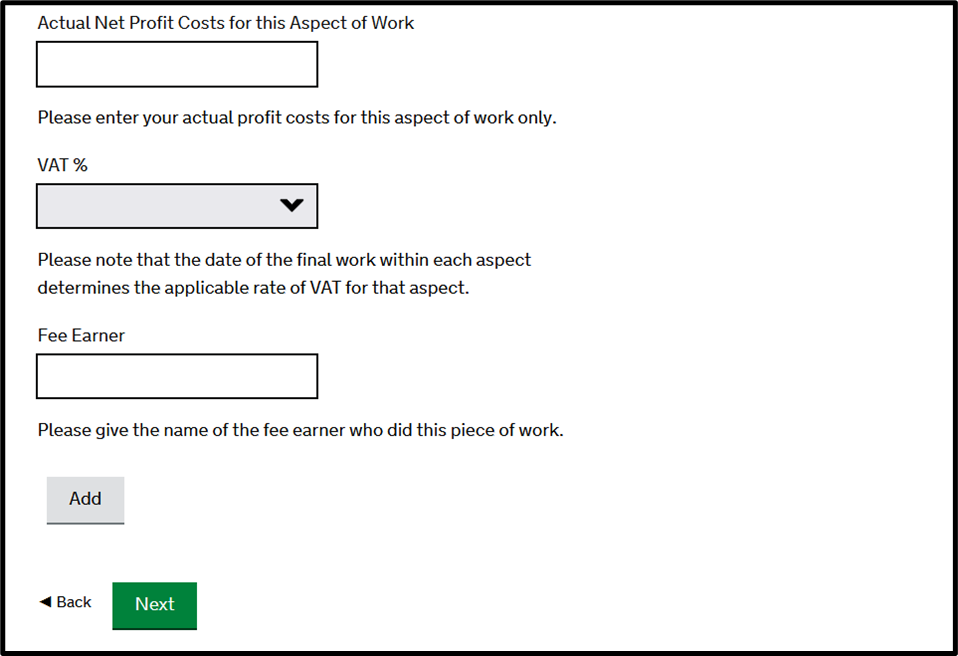

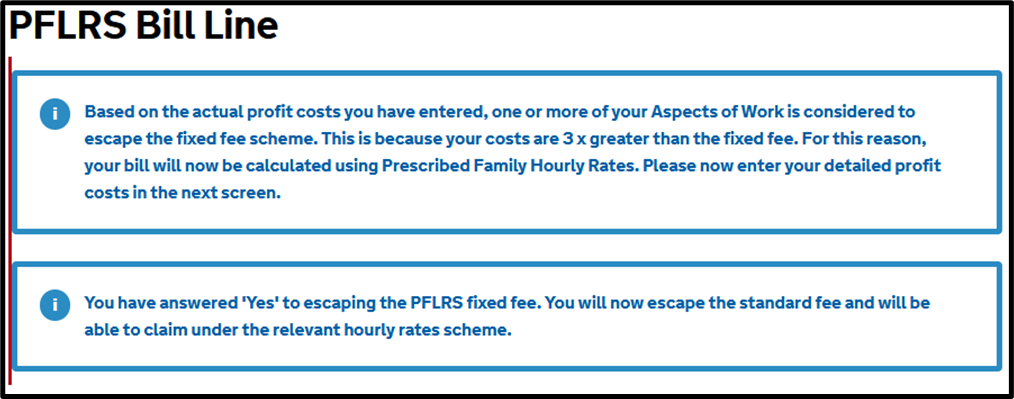

If profit costs are three times the fixed fee your claim will escape the fixed fee. You will receive the following messages and will be directed to the Prescribed Family Hourly Rates screen.

Step 7

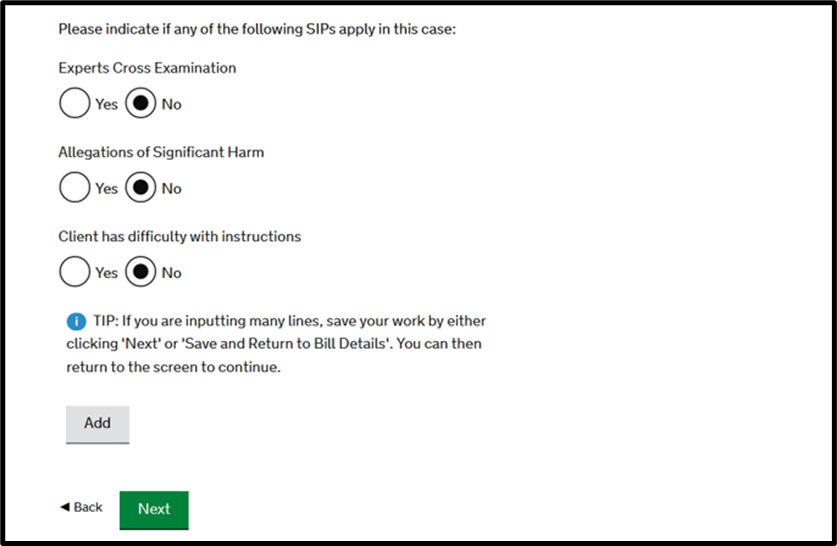

Answer ‘No’ where you have been instructed for 24 hours or more. You will then move onto the FAS screens. By answering ‘Yes’ you will progress through the hourly rate payment screens.

Step 8

Select the Domestic Abuse Aspect.

Step 9

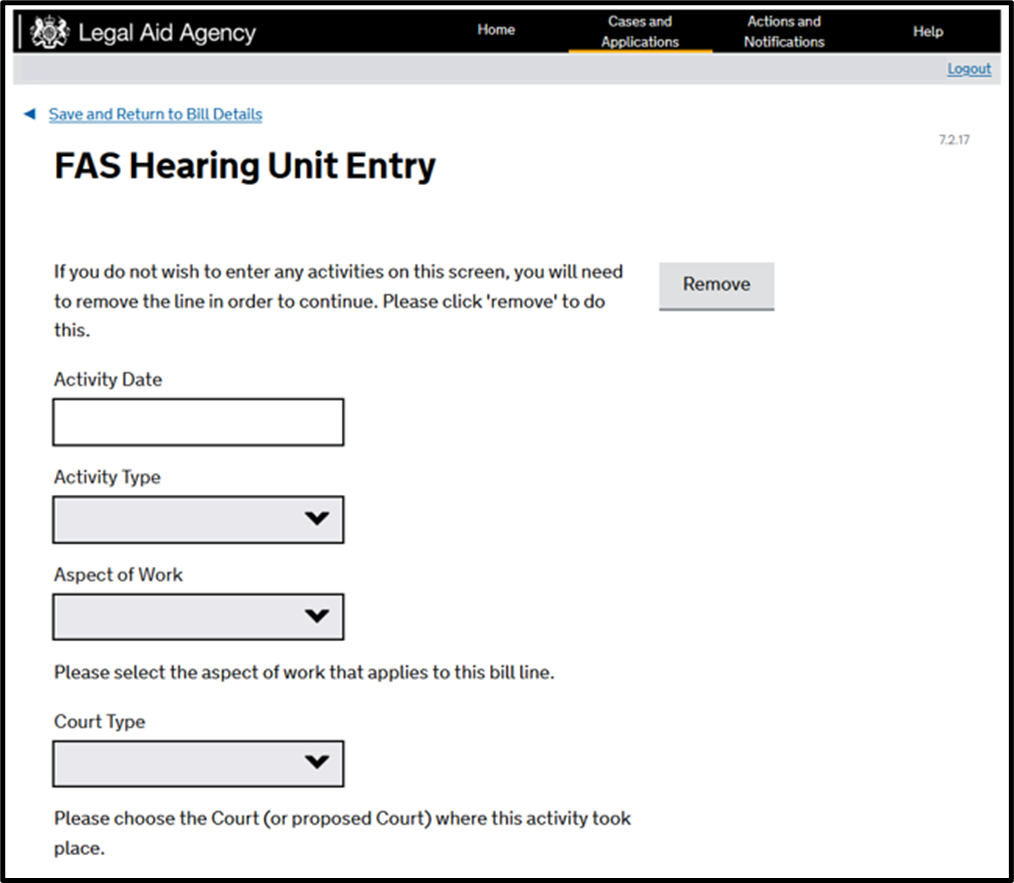

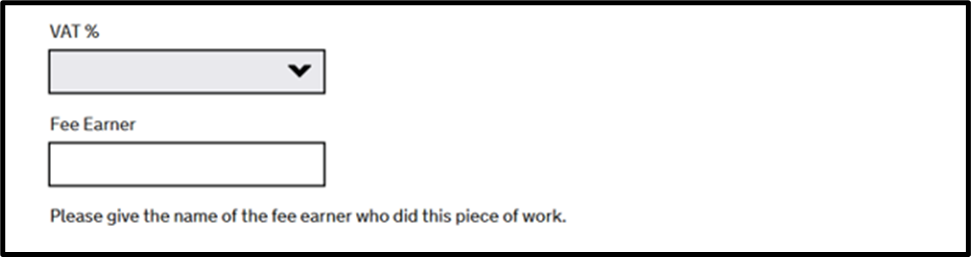

Complete the FAS section to claim a hearing and then go on to complete the FAS Non-Hearing Unit Entry screen.

Step 10

Enter details of any disbursements before checking the Assessment Summary and confirming this is correct.

Supporting Documents (Back to top)

CCMS will generate an automatic document request once your final bill has been created and you have clicked ‘Submit’.

It will appear as a notification and will request documents related to the work claimed in terms of disbursements evidence, attendance notes and counsel evidence.

Please do not send your full file of papers unless it is specifically requested by a caseworker who will direct you.

We only require certain evidence from the file which will be made clear in the notification.

Please see Section 10 of the Civil Finance Electronic Handbook for Guidance on disbursements and the guide below on how to reply to the standard billing document request:

Useful contacts and guidance links (Back to top)

Contacts

Customer Service Team: Telephone 0300 200 2020

Online Support Team: Online Support

Civil Claim Fix: laacivilclaimfix@Justice.gov.uk

Guidance Links

Guidance in relation to the use of the fixer mailbox

Civil Finance Electronic Handbook – all current guidance for all things civil billing

Costs Assessment Guidance (CAG) covers points to help with assessment and submission of bills

LAA’s Training and Support Website contains all the current CCMS guidance on how to navigate and manage the system

Billing Enquiries

Should you have any billing related queries, please lodge a Billing Enquiry on the case in CCMS.