For profit costs you must wait 3 months from the grant of the certificate and you can claim four amounts within a 12 month period. You will still only get paid up to 80% of these costs. In CCMS you’ll enter 100% of the profit costs incurred to date and the system will calculate the reduction before payment.

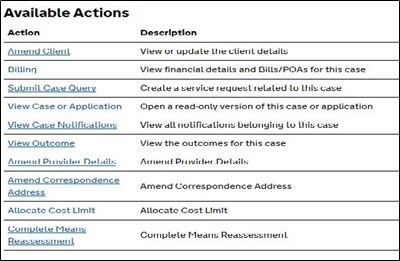

Search for the case you require by using Cases and Applications. In your Available Actions click on the Billing link.

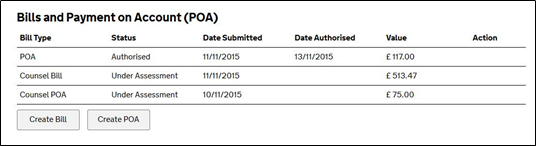

From the Case Statement of Account screen you can see the financial breakdown of your case.

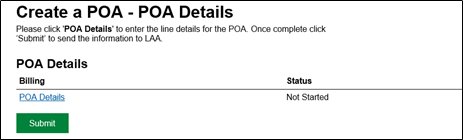

Click POA Details.

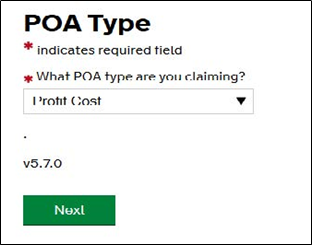

Select Profit Cost for the POA type.

Click Next.

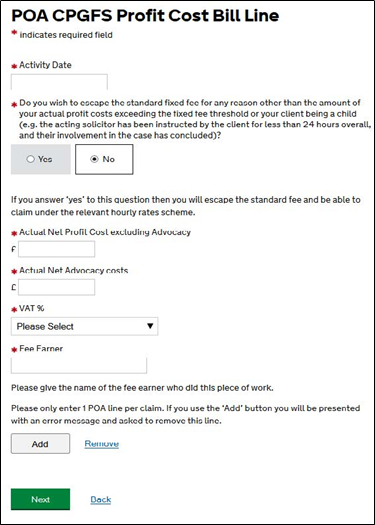

Complete the POA Profit Cost Line.

Click Next.

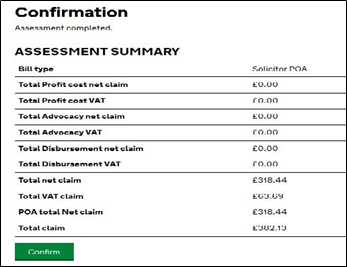

You can see brief information about the POA you have created.

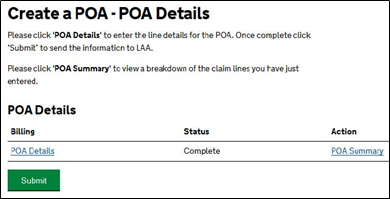

You are then returned to the Create a POA – POA Details screen.

The status of the POA is now Complete.

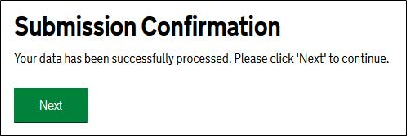

A Submission Confirmation screen confirms the POA has been sent to the LAA.

NOTE: Once your POA has been submitted, you will receive a documents required action. The documents required action will be sent to the user who submitted the POA. We cannot process the POA until we have received all supporting documents.