This guidance has been introduced to show the level of detail caseworkers find useful in supporting documents when paying lengthy family bills on CCMS.

It sets out the required information in a clear and logical way to help pay your claim first time.

NOTE: This is additional guidance to assist you and is not a mandatory requirement. This guidance does not replace the need for you to complete your claim on CCMS in the usual manner.

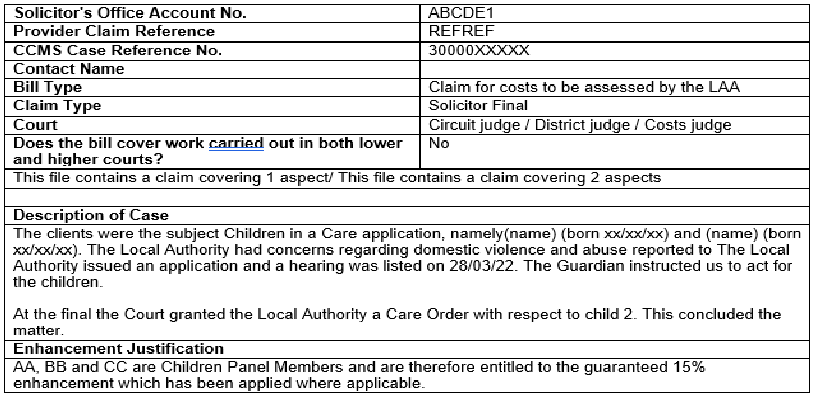

General Details

The following information should be included as general details:

- solicitor’s office account number

- provider claim reference

- CCMS Case reference number

- contact name

- bill type

- claim type

- court

- whether your bill covers work carried out in both lower and higher courts

- a description of the case

- enhancement justification

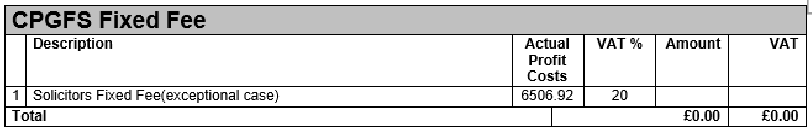

Care proceedings graduated fee scheme (CPGFS) fixed fee

The following information should be included for CPGFS fixed fee:

- actual profit cost

- VAT percentage

- amount

- VAT

- total

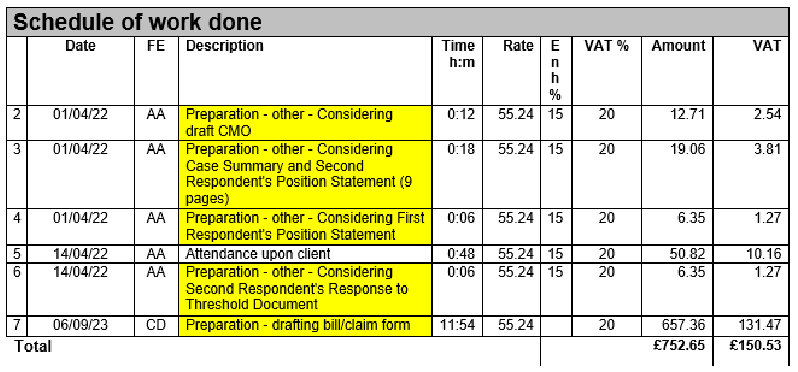

Schedule of work done

The following information should be included for the schedule of work done:

- date

- fee earner (FE)

- a description of the work, such as: Preparation – drafting bill, preparation – other – considering draft CMO, attendance upon client

- time taken displayed as hours: minutes

- rate

- enhancement percentage

- VAT percentage

- amount

- VAT

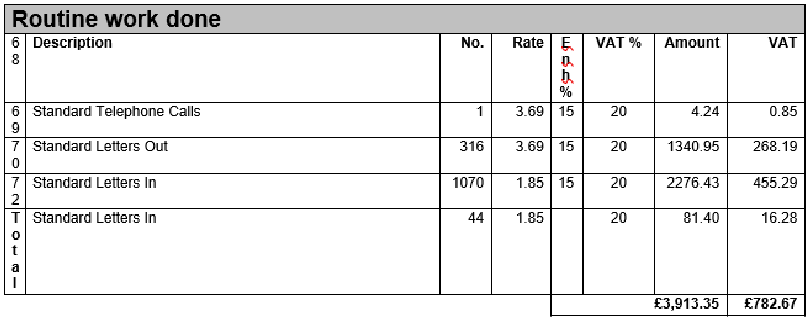

Routine work

The following information should be included for the routine work done:

- a description of all routine work undertaken, such as standard telephone calls and standard letters in / out

- number of routine items

- rate

- enhancement percentage

- VAT percentage

- amount

- VAT

- Total amount and total VAT

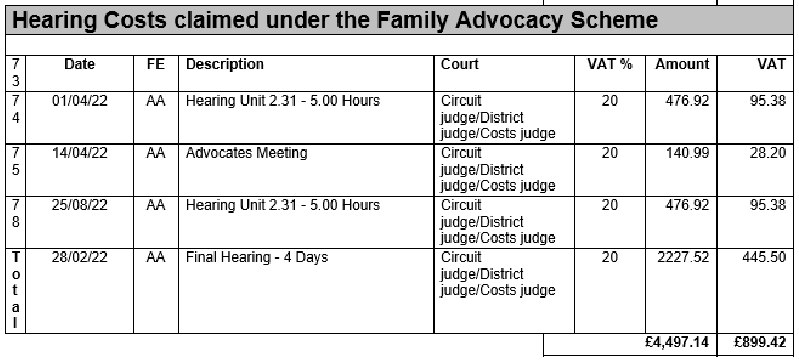

Hearing costs claimed under family advocacy scheme (FAS)

The following information should be included for the hearing costs claimed under FAS:

- date

- fee earner (FE)

- a description of the work, such as Hearing unit 2.31 – 5.00 hours, and Advocate meeting

- court

- VAT percentage

- amount

- VAT

- Total amount and total VAT

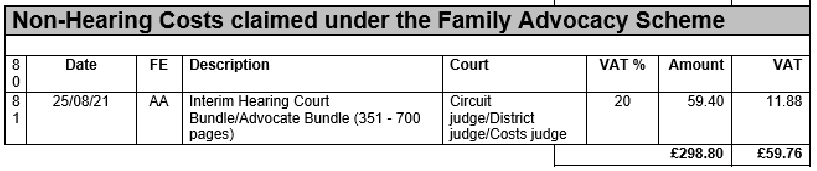

Non-hearing costs claimed under FAS

The following information should be included for the non-hearing costs claimed under FAS:

- date

- fee earner (FE)

- a description of the work — for example, Interim hearing court bundle

- court

- VAT percentage

- amount

- VAT

- Total amount and total VAT

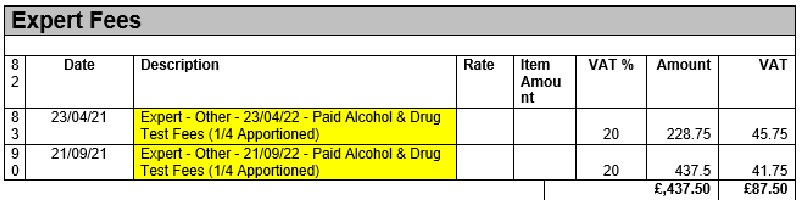

Expert fees

The following information should be included for expert fees:

- date

- a description of the work, such as Expert – other – (date) – paid alcohol and drug test fees

- rate

- item amount

- VAT percentage

- amount

- VAT

- Total amount and total VAT

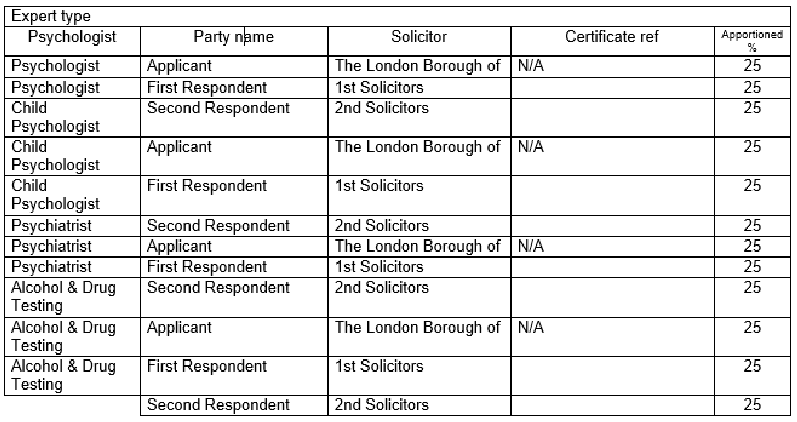

NOTE: Where there is a joint instruction of an expert, you must list all other parties to the proceedings and the apportioned percentage share of the experts’ costs (if a party is not responsible for a share of the expert costs, then list and enter 0% as their share).

The following information should be included for each expert type:

- expert type, such as psychologist, psychiatrist, alcohol or drug testing

- party name, such as applicant or first / second respondent

- name of the solicitor

- certificate reference (if applicable)

- apportioned percentage

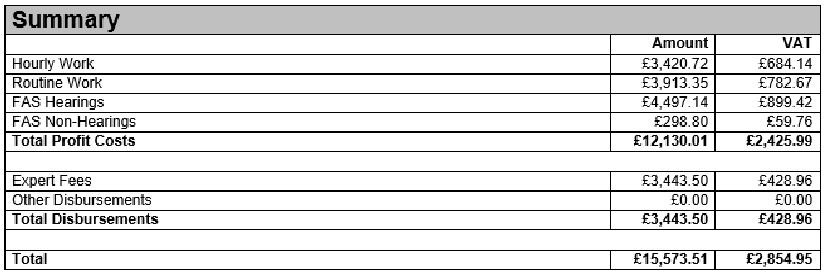

Summary

The following information should be included in the summary:

- total profit costs amount and VAT

- total disbursements and VAT

- total of both costs and VAT